Contents:

A back-test equity curve of this strategy using weekly moves from open to close greater than 2% in value trading 16 Forex currency pairs and crosses from 2001 to 2020 is shown below. Trades were hypothetically entered at the end of a qualifying week and held until the next week’s close. Spreads and overnight financing payments/charges were not included. The market tried to push above first, but as it failed and then previous level of support turned to resistance, we got a good short entry in line with the weekly open level.

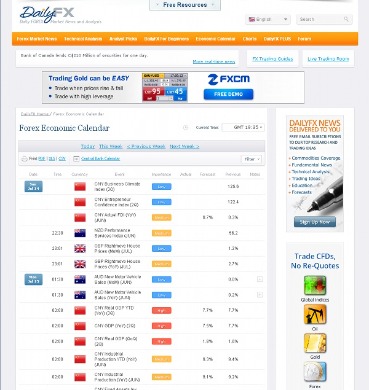

Strategy Webinar: US Dollar Majors, S&P 500, Gold, Oil, FOMC Outlook – DailyFX

Strategy Webinar: US Dollar Majors, S&P 500, Gold, Oil, FOMC Outlook.

Posted: Tue, 26 Jul 2022 07:00:00 GMT [source]

The range high and low then come into play as trade filters, depending on their locations relative to the opening tick. As with any forex strategy, you should have good trading discipline and forex money management. This can be the difference between a winning and losing strategy. I have seen the exact some weekly forex strategies produce a different set of results simply due to the stop loss and take profit levels being used. Try not to let negative emotions such as fear, anger and greed get in the way. The weekly trading strategy is based on the analysis of the exponential moving average.

Discovering the Best FX Strategy for You

A https://g-markets.net/ with a rising value will have so many ups and downs. But it all happens in the more significant and consistent rising trend. To shut down an indicator, one has to remove it from the chart.

USD Majors, Gold, S&P 500, FOMC & NFP- Weekly Technical Outlook – DailyFX

USD Majors, Gold, S&P 500, FOMC & NFP- Weekly Technical Outlook.

Posted: Tue, 01 Nov 2022 07:00:00 GMT [source]

The principle works in many ways but shows its greatest value when price returns to test the opening print, from above or below, after it has established a morning trading range. That progression can take between 30 minutes and two hours, depending on volatility. Once in place, draw three lines across 5- or 15-minute charts, at the range high, range low and opening print. Relative positioning between these levels yields all sorts of useful information and trading signals. Put simply, these are price points extended into the future from the opening candle of each year, month and week, similar to how you’d plot a typical support/resistance level.

Forex weekly strategy

In the second week also we can see the crossing of 20 moving average at weekly,s low and close at 1 hour chart on Tuesday as shown below. The three data points bring order into typical morning chaos, allowing you to set first strategies into motion while the majority is struggling to evaluate the market tone. This extra insight generates a well-defined trading edge that adds predictive power in very short time frames, giving you a leg up on the path to profitability. Forex trading is all about trading with the trend, so a weekly trading system is likely to produce better results. It’s about using indicators on a weekly chart that can help you stay on top of the direction of momentum. You’re less likely to get caught up in trading on minor shifts within the bigger trend.

One way to help is to have a range of the best Forex trading strategies that you can stick to. Swing trading is an attempt to capture gains in an asset over a few days to several weeks. Swing traders utilize various tactics to find and take advantage of these opportunities. An ascending triangle is a chart pattern used in technical analysis created by a horizontal and rising trendline.

Should You Use Only One Time Frame in Forex Trading?

On paper, counter-trend strategies can be one of the best Forex trading strategies for building confidence, because they have a high success ratio. One potentially beneficial and profitable Forex trading strategy is the 4-hour trend following strategy which can also be used as a swing trading strategy. This strategy uses a 4-hour base chart to screen for potential trading signal locations. The 1-hour chart is used as the signal chart, to determine where the actual positions will be taken. 1.Scalping – These are very short-lived trades, possibly held just for just a few minutes. A scalper seeks to quickly beat the bid/offer spread, and skim just a few pips of profit before exiting and is considered one of the most advanced Forex trading strategies out there.

- Obviously, there is also a probability that the price will not revert back to its mean.

- We can measure extreme price changes relative to the time frame used.

- This has come at a great time for me who at the moment has lost all confidence in trading.

In the chart below we outline a regression channel, where the middle line is the linear regression. The middle line is simply the average price going from the initial point we used to draw the channel till the end. Share your opinion, can help everyone to understand the forex strategy.

Different Types of Forex Trading Strategies

After these conditions are set, it is now up to the market to do the rest. Day trading and scalping are both short-term Forex trading strategies. However, remember that shorter-term implies greater risk due to the nature of more trades taken, so it is essential to ensure effective risk management. Adam Lemon began his role at DailyForex in 2013 when he was brought in as an in-house Chief Analyst.

Please note that such forex weekly open strategy analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. The trend continues until the selling is depleted and belief starts to return to buyers when it is established that the prices will not decline further. Trend-following strategies encourage traders to buy the market once it has broken through resistance and sell a market once they have fallen through support.

Put simply, these terms represent the tendency of a market to bounce back from previous lows and highs. Investments involve risks and are not suitable for all investors. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

These Forex trading strategies rely on support and resistance levels holding. But there is also a risk of large downsides when these levels break down. The market state that best suits this type of strategy is stable and volatile. This sort of market environment offers healthy price swings that are constrained within a range.

I have many years of experience in the forex industry having reviewed thousands of forex robots, brokers, strategies, courses and more. I share my knowledge with you for free to help you learn more about the crazy world of forex trading! You will have to implement the best momentum trading strategy to manage your trading account. The momentum trading indicator can reduce the chance of risk. Therefore, the effects of the momentum strategy are prevalent.

By monitoting those actual tendencies and forecasting them, the trader may choose the best weekly forex strategy. Multiple time frame analysis is simply looking at two or more price charts for the same Forex currency pair or cross or other instrument, at the same time. The simplest application comes when price retraces to those levels during the intraday session. Watch closely for small-scale breakouts, breakdowns, reversals and failures, using those swings as short-term entry and exit signals.

Samantha Silberstein is a Certified Financial Planner, FINRA Series 7 and 63 licensed holder, State of California life, accident, and health insurance licensed agent, and CFA. She spends her days working with hundreds of employees from non-profit and higher education organizations on their personal financial plans. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. Read our editorial process to learn more about how we fact-check and keep our content accurate, reliable, and trustworthy.